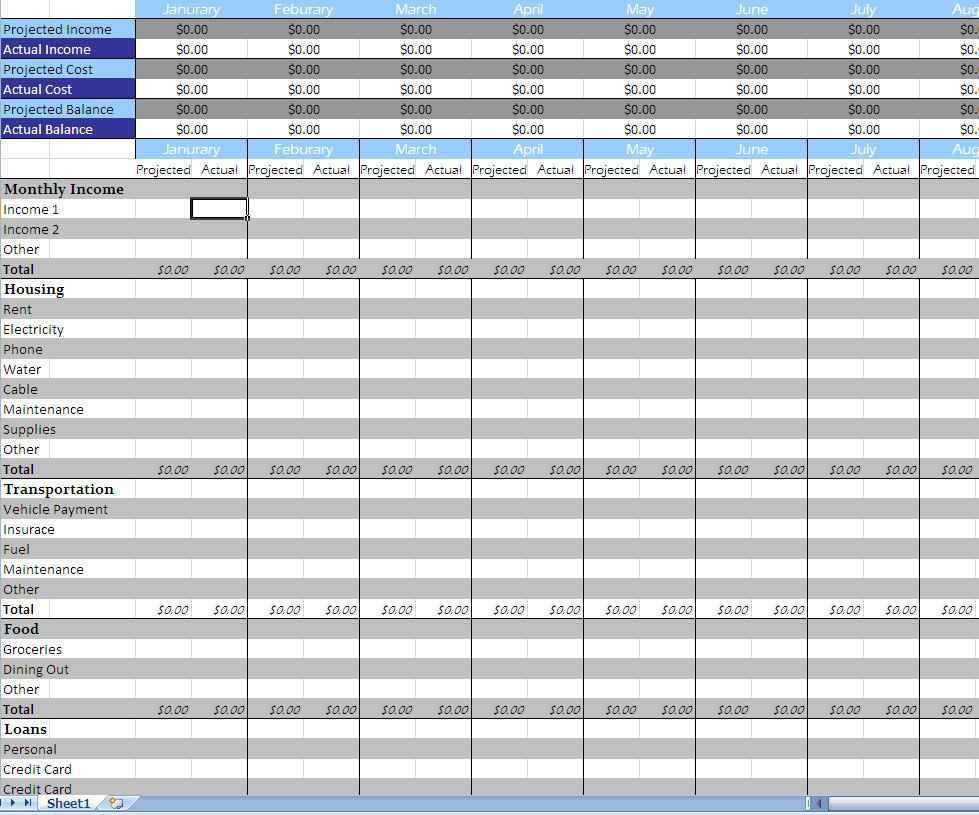

I started out using Excel to do everything, but I began using Quicken after a friend showed me how easy it was to keep track of checks and credit card charges and download transactions directly from my bank. A budget is almost useless without tracking what you are spending. For expense tracking, you could use my Income and Expense Worksheet, Checkbook Register, or the newer Money Manager. Tracking your income and spending comes both before and after making a budget. For example, I like to use cell comments to explain certain budgeted items in more detail (such as the fact that in May, there is Mother's Day and a couple of birthdays to remember).Ĭreating a simple personal budget (even if it is only on paper) is one of the first steps to gaining control of your spending habits. The reason I use Excel when working with my home and business budgets is that it gives me complete flexibility to keep track of the information the way I want to. If you don't own Excel, then Google Sheets and OpenOffice are free options to consider.

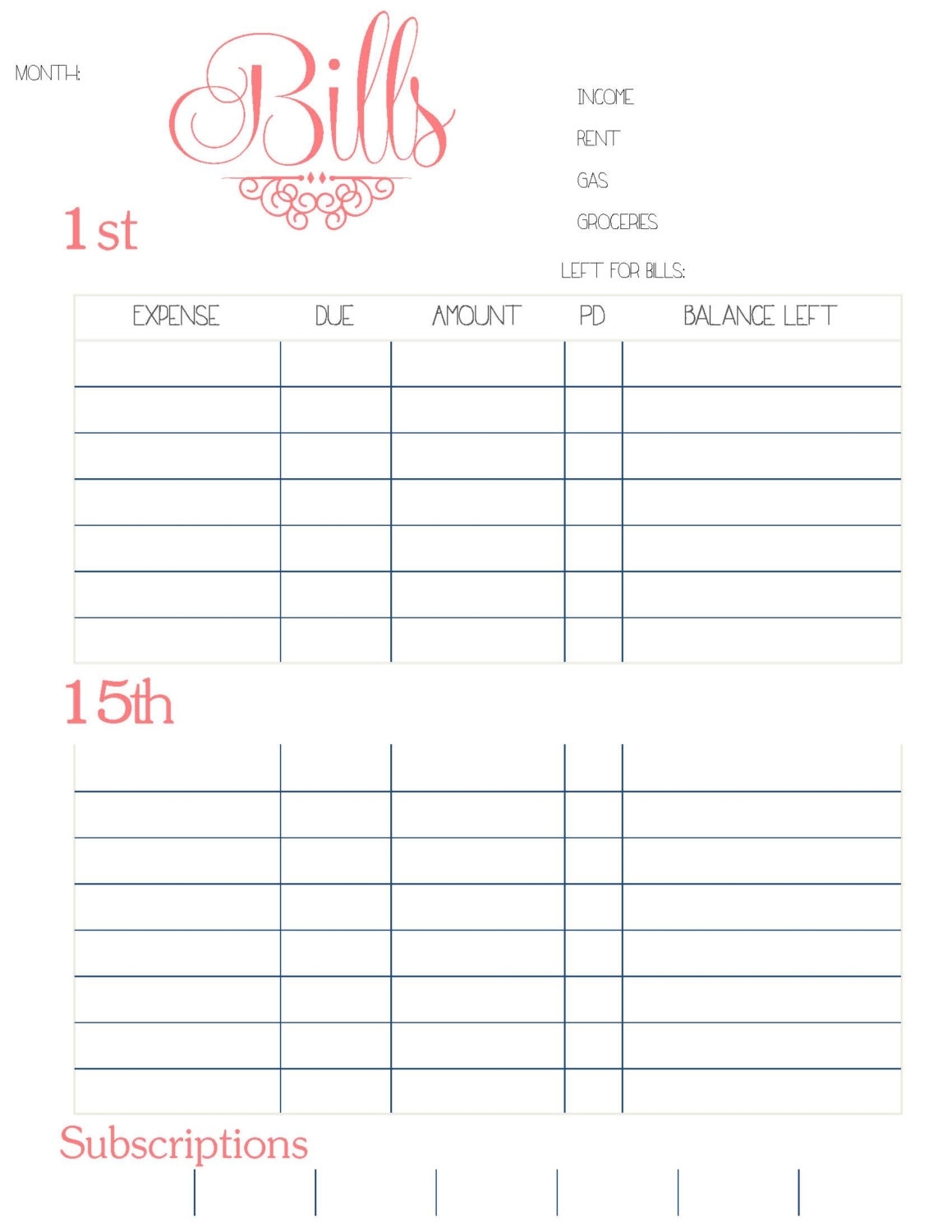

Microsoft Excel isn't free, but if you already own Excel, then you can create a budget without purchasing other budgeting software. The Total Paid row at the bottom will sum the amounts that are checked.42 Effective Ways to Save Money Budgeting Tips for the New Year Why Use Excel for your Personal Budget?įirst reason: it's free. If you prefer to continue editing the spreadsheet on your computer, you can use the drop-down in the checkbox columns to check off when a bill is paid. If a payment is variable, you can enter the average amount at first, and then update it with the actual amount after you get the bill.įinally, you can print a copy of the worksheet if you want to include it in your planner or display it somewhere as a reminder.

Next, enter the expected amounts for the bills for each month. The Day column is just for your own reference. In the Day column, you can list the day of the month that the bill is typically due, such as 1st, 15th, EOM (for end-of-month), etc. I would recommend listing them in order of priority, with the most critical bills to pay at the top. How to Use the Bill Tracker Worksheetįirst, list all your expected bills. You may not need this if you are already using the money management spreadsheet, but if you like to manage your budget by hand, this worksheet can be a very useful tool to include in your budget planner. You can use this bill tracking spreadsheet to list all your recurring bills with their expected payment amounts, and then check them off when they are paid.

0 kommentar(er)

0 kommentar(er)